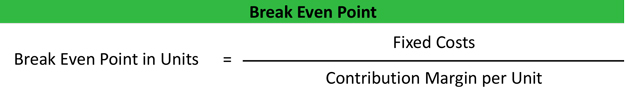

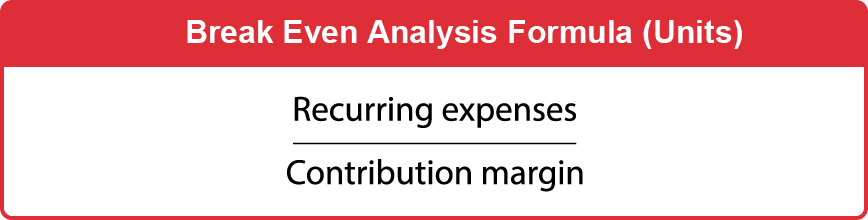

Then, figure the per-share cost by dividing the total cost by the number of shares you have the option to buy or sell. Before you can start figuring the Break-even Point, you must calculate how much the option cost to purchase. Depending on the option you buy, it’s possible to make money when the price goes up or down. Regarding the stock market, you could make money using stock options. In real estate, you need to know three key pieces of information- the debt service of the property (payments that are geared towards reimbursing the interest and principal on a loan), the operating expenses of a property (accounting, insurance, maintenance, repairs, taxes, and utilities), and the gross operating income of the property (the gross potential income minus the vacancy loss and credit loss). The accounting Break-even Point is calculated by taking the total expenses on a particular production and calculating how many units of the product must be sold to cover the expenses paid. More sales mean there will be a profit, while fewer sales mean there will be a loss. A company must maximize revenue to cover its fixed and variable costs. The first pieces of information needed are the fixed costs and the gross margin percentage. The information required to calculate a business's Break-even Point can be found in its financial statements. The break even cost is reached when the two prices are equal.

The Break-even Point (or Price) for a trade or investment is determined by comparing the market price of an asset to the original cost. The stock market is another industry in which Break-even Point can be frequently seen. In real estate, a property's Break-even Point would show how much money the owner would need from a sale to precisely offset the net purchase price (including closing costs, fees, insurance, interest, and taxes) in addition to the costs connected to home maintenance and improvements. In accounting, Break-even Point refers to a situation where a company's revenues and expenses were equal within a specific accounting period. Existing businesses can use Break-even Points to analyze costs, including operating costs, and profits, in addition to showing the ability to rebound from difficult circumstances. Some new businesses will struggle during the first year and may take several years to earn a profit. If you’re a new business, people who are interested in investing in your business will want to know their return and when they will receive it.

All costs that must be paid have been paid, and there is neither a profit earned nor a loss incurred.Ī Break-even Point is used in a wide variety of situations. In other words, you “break even”, which means that there is no net loss or gain. For this reason, break-even point is an important part of any business plan presented to a potential investor.įor existing businesses, this can be a useful tool not only in analyzing costs and evaluating profits they’ll earn at different sales volumes, but also to prove their potential turnaround after disaster scenarios.Break-even Point (BPE) in accounting, economics, finance, and real estate is the point at which total cost and total revenue are equal. This is because some companies may take years before turning a profit, often losing money in the first few months or years before breaking even. Potential investors in a business not only want to know the return to expect on their investments, but also the point when they will realize this return. In other words, you've reached the level of production at which the costs of production equals the revenues for a product.įor any new business, this is an important calculation in your business plan. The break-even point is the point at which total cost and total revenue are equal, meaning there is no loss or gain for your small business. Pacific Northwest region media contacts.

Market research and competitive analysis.

0 kommentar(er)

0 kommentar(er)